(Malay Mail Online) – Today, the Ringgit breached RM4.00 for a dollar.

When I logged in to my Facebook and Twitter accounts, 9 out of 10 posts that appeared on my timeline were slamming the Government on the Ringgit.

To sum them up, youths who dominate social media today were posting comments as though tomorrow spells the end for Malaysia.

And in just the past month, I saw how Malaysians transform from being constitutional experts, to aviation analysts and now economics.

Some even went as far as pushing the blame on Umno and Najib. There’s this group called Suara Rakyat who likes to say “other countries are doing better because Umno is not there in their country”.

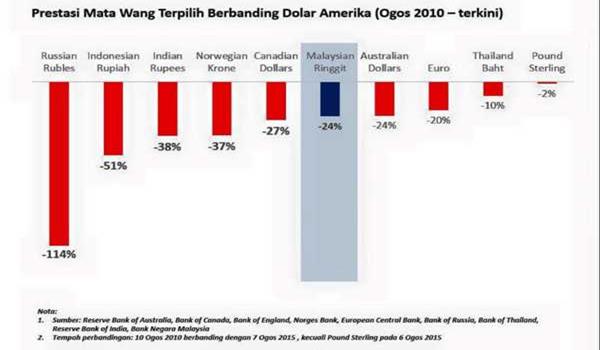

Of course, when you have a narrow, myopic view, you will tend to miss out the fact that over the 5 year period,

• Russian Roubles lost 114per cent against USD

• Indonesian Rupiah lost 51per cent against USD

• Indian Rupees lost 38per cent against USD

• Norwegian Krone lost 37per cent against USD

• Australian Dollars lost 24per cent against USD

• Euro lost 20per cent against USD

• Thai Baht lost 10per cent against USD

Do I need to go on?

One of the contributing factors faced by these countries is the drop in oil prices. Crude oil was trading at US$70-80/bbl few years ago and today it has fallen below US$ 50 per bbl.

Also, US is not our only trading partner and the performance of our Ringgit is not measured against US dollars alone.

When we look at the Ringgit,

• we strengthened against Canadian Dollars (2per cent)

• we strengthened against Indian Rupees (10 per cent)

• we strengthened against Japanese Yen (14 per cent)

• we strengthened against Indonesian Rupiah (18 per cent)

I don’t need to name more currencies, do I?

Do you know that the value of our trade with India, Japan and Indonesia is close to 20per cent?

Understandably, we are quick to feed on negative news and quick to comment like an expert on our Facebook and Twitter. That’s how things work these days.

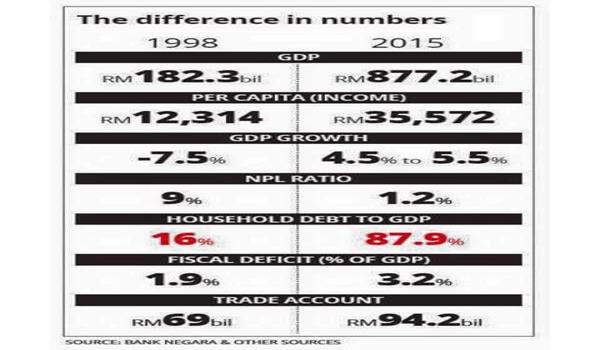

Of course, none of you made reference to 1998.

No one remembered the time when the Ringgit crashed to as low as RM4.725 for a dollar on 7 January 1998 (BNM selling rate, over the counter was more than RM4.80).

All of you, who were quick to comment about the state of our economy on your Facebook, were still in school.

So none of you knew, none of you remembered, none of you experienced what happened in 1998 when Anwar Ibrahim was Finance Minister.

Back then

a) People were losing jobs or had difficulty in getting jobs

b) Households were squeezed

b) average lending rate was 12.16 per cent

c) Inflation was close to 3 per cent without subsidy removals.

If any of you doubt the 2-3 per cent inflation numbers today and felt it is way higher, apply the same thought to 1998-1999.

And yes, average lending rate was over 12 per cent. Those were the days.

You may say it is history and you may continue to slam the Prime Minister, the Central Bank and the Government for today’s numbers.

But the next time before you give you get upset and share your anger on Facebook or Twitter, ask yourself whether or not the Ringgit — Dollar exchange rate affects you, and how.

1. Do you shop online from US websites?

2. Are you planning to fly over to US for a holiday?

3. Are you a Malaysian studying in the US?

4. Do you import goods to be resold in Malaysia?

5. Do you buy necessities and food from the US to use here?

6. Do you at all use the US dollar in your daily life?

Because my dear, only if you answer yes to the above, you are affected. Otherwise, what are you shouting and so worried about?

Your salary is still denominated in Ringgit and you don’t buy necessities with US dollars.

Sure, no one can deny that it has some impact to some segments especially imports and our plans to travel to US, UK etc. I am also of the opinion that there are many things Najib can do (which he isn’t at all now) and I will share more soon.

And guys, the international ratings agencies — Fitch, Moody’s and S&P — have all maintained Malaysia’s outlook as stable.

There are no economists out there who are saying that Malaysia’s economy will collapse, only politicians are saying this.